Innovative Applications of New Technologies in Denture Manufacturing How 3D Printing and Other Advances are Transforming the Process

2025-04-07

2026-01-18

Latin America's dental CAD/CAM sector is experiencing steady expansion as part of the broader digital dentistry transformation. The regional dental devices market, encompassing CAD/CAM systems, reached approximately USD 0.74 billion in 2025 and is projected to grow to USD 1.01 billion by 2030 at a CAGR of 4.53%. Within this, the CAD/CAM segment—including intraoral scanners, milling units, and software—benefits from faster sub-growth in digital diagnostics at around 5.23% CAGR through 2030.

This acceleration stems from rising oral disease prevalence, an expanding middle class seeking aesthetic treatments, and dental tourism in key hubs. Digital impressions in the region surged 42% year-on-year to 85,000 cases in 2024, signaling widespread shift from traditional methods to CAD/CAM-enabled workflows for crowns, bridges, implants, and aligners.

Brazil stands as the clear leader, commanding about 35.65% of the regional dental devices share in recent data and driving the majority of CAD/CAM momentum. As the region's largest economy and population base, Brazil benefits from a high burden of oral diseases affecting millions, particularly in underserved areas. Government programs like the National Oral Health Policy and Digital Health Strategy (2020-2028) actively promote CAD/CAM integration into public and private care, improving access and efficiency. Regulatory reforms have streamlined approvals for digital devices, supporting faster adoption in both urban centers like São Paulo and Rio de Janeiro and expanding rural outreach.

Brazil's market shows embedded growth of around 5-6% CAGR in dental devices trends—above the regional average—fueled by private dental service organizations (DSOs), lab modernization, and increasing chairside systems for same-day restorations. Dental tourism further boosts demand, with patients from North America and Europe seeking cost-effective, high-precision treatments using digital workflows.

Mexico follows as a strong second, leveraging proximity to the United States and robust medical tourism in cities like Tijuana and Cancun. Cross-border patients drive demand for efficient CAD/CAM processes that enable quick, high-quality prosthetics. Mexico's growth tracks closer to 4-5% CAGR, supported by imports, supply chain integration with North America, and private clinics upgrading to digital scanners and milling. While smaller in absolute scale than Brazil, Mexico excels in cost-competitive services and teledentistry linkages, contributing to regional uplift from tourism estimated at 1.20% CAGR impact.

Argentina ranks third among major players, with adoption concentrated in urban areas like Buenos Aires. Growth hovers around 4% CAGR, constrained by economic volatility, inflation, and slower infrastructure rollout. Despite challenges, potential exists through regional collaborations like Mercosur tech-sharing initiatives and growing private sector interest in 3D printing and milling for restorative work. Argentina's market remains promising if stability improves, but it lags Brazil and Mexico in scale and pace.

Key comparative factors include:

Looking ahead to 2030, Latin America's CAD/CAM rise will continue, though below global averages of 8-10%. Brazil is poised to maintain leadership through sustained investment and policy support, Mexico to capitalize on tourism recovery, and Argentina to gain if economic conditions stabilize. Overall, the shift to digital enhances precision, reduces treatment time, and improves patient outcomes—positioning the region for stronger integration into global dentistry standards.

For practices and patients in Latin America, embracing CAD/CAM means accessing modern, efficient care amid evolving market dynamics. As adoption accelerates, Brazil's frontrunner status underscores the transformative potential of digital tools in addressing oral health needs across the continent.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

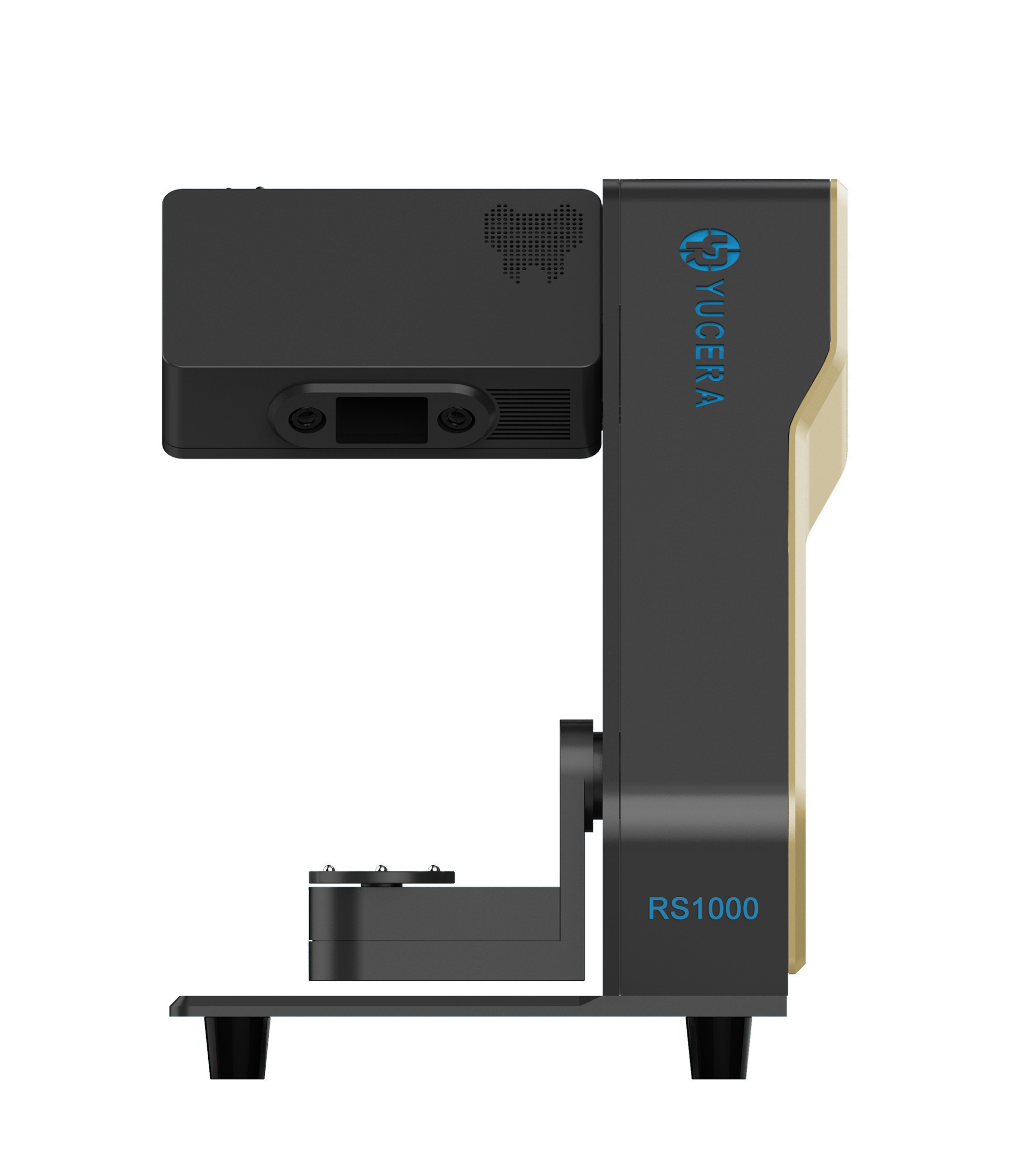

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

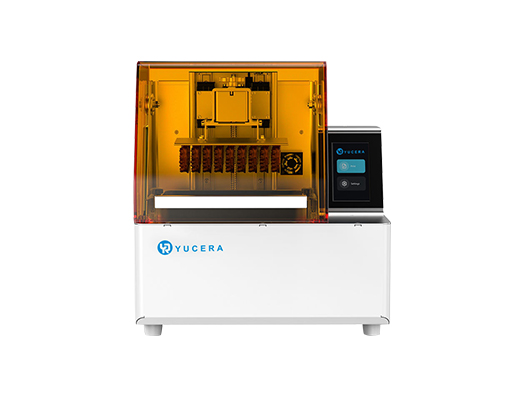

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more

2025-04-07

2025-04-08

2024-10-21