Benefits of Zirconium Dioxide All-Ceramic Teeth

2024-10-16

2026-01-16

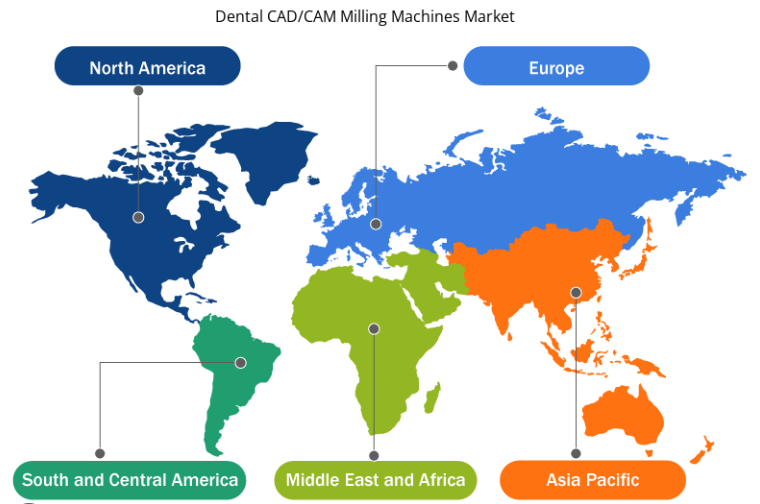

North America, particularly the United States and Canada, stands as a powerhouse in the dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) sector, driving global advancements in digital dentistry. This technology revolutionizes restorative procedures by enabling precise, efficient fabrication of crowns, bridges, veneers, inlays, onlays, abutments, and frameworks directly from digital scans. With market dominance fueled by high adoption rates, robust infrastructure, and continuous innovation, the region accounts for over 38-42% of the global share. In 2025, the global dental CAD/CAM market is valued at approximately $2.4 billion, projected to reach $5.65 billion by 2034 at a CAGR of 10.01%, with North America leading due to its technological edge.

The US, with its advanced healthcare ecosystem, commands the lion's share, while Canada complements with strong growth in digital adoption and esthetic-focused practices. Factors like an aging population, rising dental disorders, cosmetic demand, and supportive regulations propel this leadership. In urban hubs like Los Angeles, where aesthetic dentistry thrives, CAD/CAM systems reduce treatment times, enhancing patient experiences in high-volume clinics. This article analyzes market dynamics, growth trajectories, and technological breakthroughs in the US and Canada, highlighting why North America maintains its dominance through 2030 and beyond.

The North American dental CAD/CAM market is experiencing robust expansion, outpacing global averages in adoption and innovation. In 2023, the broader North American digital dentistry market, encompassing CAD/CAM, was on track for a 9.9% CAGR through 2030, driven by increasing edentulism and procedural demands. Globally, CAD/CAM milling machines alone were valued at $1.96 billion in 2023, with North America holding 42.74%—projected to grow at 9.1% CAGR to $4.34 billion by 2030.

United States Leadership: The US dental CAD/CAM market was worth $762.4 million in 2022, expected to grow at 9.2% CAGR through 2030, reaching over $1.5 billion. By 2026, it's projected at $0.95 billion, part of North America's $1.02 billion total. Growth stems from 60%+ adoption in dental practices, fueled by rising dental diseases (affecting 90% of adults) and cosmetic procedures. In states like California, including Los Angeles, demand surges due to high cosmetic interest and access to advanced labs.

Canada's Steady Ascent: Canada's dental equipment market, including CAD/CAM, reached $635.4 million in 2023, forecasted to hit $918.8 million by 2030 at 5.4% CAGR. The broader dental market is valued at $4.72 billion in 2023, with CAD/CAM adoption growing at 12.4% CAGR through 2030, faster than the US's 9.9%. Provinces like Ontario and British Columbia lead, with 11% of Canadians facing periodontal issues driving demand. Overall, North America's market is set to contribute significantly to the global $6.22 billion by 2033.

Compared to Europe (projected highest CAGR of 11.4% in some segments), North America's edge lies in scale and integration. Dental laboratories, valued at $9.2 billion globally in 2025 (31.8% North America), rely heavily on CAD/CAM for efficiency.

North America's leadership is rooted in pioneering technologies that enhance precision, speed, and patient outcomes. From AI integration to high-speed milling, innovations reduce chair time and improve restoration quality.

AI and Machine Learning Integration: AI-powered CAD/CAM systems automate designs, predict wear, and optimize workflows. In 2023-2026, advancements include AI-enhanced scanners for real-time diagnostics, reducing errors by 20-30%. In the US and Canada, launches like next-gen software in 2021-2023 promote single-visit dentistry, with automatic proposals speeding processes. AI aligns intraoral/extraoral scans for virtual patients, boosting accuracy in Los Angeles' esthetic-focused clinics.

High-Speed and Multi-Axis Milling: Spindles reaching 100,000 RPM enable 15-25 minute zirconia crowns. 5-axis systems dominate for complex geometries like implant abutments, with North America leading adoption (70%+ in labs). Hybrid wet/dry mills expand material compatibility to 10+ types, including lithium disilicate and titanium.

Intraoral Scanners and Digital Workflows: Advanced scanners with AI achieve 5-10 micron accuracy, replacing impressions. In Canada, digital radiography and CAD/CAM integration grows at 5.4% CAGR. US investments, like $113M in 2025 for digital expansion, accelerate this.

VR/AR and Generative Design: Emerging VR/AR for immersive planning and generative algorithms for biocompatible restorations are set for 2026 rollout. These enhance training in Canadian universities and US practices.

Material Innovations: Multilayer zirconia and hybrids improve esthetics, with North America leading R&D for durable, translucent options.

The US FDA's 510(k) clearances streamline innovations, as seen in 2025 zirconia approvals. Canada's Health Canada aligns, fostering cross-border tech flow. Reimbursement policies cover 20-40% of procedures, boosting adoption. Economic drivers include $3.8% US health spending growth in 2023, with dental lagging but poised for CAD/CAM surge.

Challenges include high costs ($20,000-80,000 per system) and training needs, but ROI in 12-24 months via efficiency gains mitigates this. By 2030, AI and cloud integration will push North America's share higher, with US at $3.63 billion in digital dentistry.

North America's dental CAD/CAM dominance, led by the US and Canada, is anchored in market scale, rapid growth (9-12% CAGRs), and technological prowess in AI, milling, and digital integration. As global demand rises, regions like Los Angeles will continue benefiting from these advancements, ensuring superior patient care and industry leadership through 2030.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more