What is a dental cad cam milling machine

2024-07-06

2026-01-17

Europe's dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) market exemplifies a diverse ecosystem shaped by national healthcare systems, demographic trends, and technological priorities. As a cornerstone of digital dentistry, CAD/CAM enables precise fabrication of restorations like crowns, bridges, veneers, and implant abutments, often in same-day workflows. The continent's market is projected to grow at a 9.0% CAGR from 2024 to 2031, reaching significant value driven by aging populations, aesthetic demands, and digital adoption. Germany, France, and the UK represent key players, each with unique strengths: Germany's engineering prowess, France's focus on innovation and reimbursement, and the UK's emphasis on private-sector efficiency.

Globally, the dental CAD/CAM market was valued at $2.4 billion in 2025, expected to reach $5.65 billion by 2034 at 10.01% CAGR, with Europe as the second-largest region after North America. In Europe, the market accounted for $735.8 million in 2024, fueled by public funding in select countries where over 60% of dental spending is reimbursed, such as Germany and France. This article compares these three nations across market size, growth, adoption rates, and advancements, offering insights for global professionals, including those in tech-savvy hubs like Los Angeles where similar trends influence cross-Atlantic collaborations.

Europe's dental CAD/CAM sector benefits from an aging demographic—over 20% of the population is 65+—increasing demand for restorations amid rising edentulism and periodontal issues. The CAD/CAM milling machine subsegment alone is set to reach $1.236 billion by 2030 at 11.6% CAGR, reflecting shifts toward in-lab and chairside systems. Key drivers include favorable insurance for restorations, aesthetic preferences, and integration of AI for workflows.

Country-wise, Germany leads with a projected value of $297.3 million by 2031, followed by France at 9.9% CAGR and the UK at 8.1%. In 2026, Germany's market is valued at $0.22 billion, the UK's at $0.11 billion, highlighting scale differences. Adoption varies: 65% of German practices use CAD/CAM by 2023, while France and the UK lag slightly but accelerate via public-private initiatives. Overall, Europe's market emphasizes precision for zirconia and glass ceramics, with hybrid wet/dry systems gaining traction for multi-material compatibility.

Germany dominates Europe's dental CAD/CAM landscape, with a market size of $193.5 million in 2024, projected to reach $435.47 million by 2035 at 7.64% CAGR. As Europe's largest economy, it benefits from robust public reimbursement—covering up to 60% of dental costs—and a dense network of over 50,000 dentists. Adoption stands at 65% in practices and labs by 2023, driven by engineering heritage that prioritizes high-precision milling and scanners.

Technological advancements focus on integration: 5-axis milling for complex geometries like implant abutments, achieving marginal fits under 50 microns. Germany's emphasis on R&D—supported by institutions like Fraunhofer—leads in AI-enhanced design software, reducing errors by 20-30%. The country excels in zirconia processing, with dry milling systems optimizing for high-volume labs. Challenges include regulatory compliance with EU MDR, but this ensures quality, making Germany a export hub.

In geo-optimized contexts like Los Angeles collaborations, German tech influences U.S. labs seeking durable restorations, with 98% of large labs adopting CAD/CAM. Future growth ties to aging demographics, with 25% of Germans over 65 by 2030, boosting demand for efficient workflows.

France's dental CAD/CAM market exhibits the highest regional CAGR at 9.9% from 2024-2031, reflecting rapid digital uptake amid public health reforms. Valued at part of Europe's $735.8 million in 2024, it benefits from strong reimbursement—up to 70% for restorations via Assurance Maladie—and a focus on aesthetic dentistry. Adoption rates hover around 50-60%, with emphasis on chairside systems for same-day procedures.

Advancements center on AI and 3D printing integration, enhancing glass ceramic processing with wet milling for brittle materials, reducing microcracks and improving translucency. France leads in minimally invasive techniques, like no-prep veneers, supported by national R&D via CNRS. The market grows via dental tourism, attracting patients from neighboring countries for cost-effective digital restorations.

Regulatory alignment with EU standards accelerates tech rollout, though rural-urban disparities pose challenges—urban areas like Paris see 70% adoption vs. 40% rurally. For global ties, such as with Los Angeles clinics, French innovations in AI shade-matching offer precision for cosmetic cases. By 2030, France's elderly population growth to 22% will drive further expansion in implant-focused CAD/CAM.

The UK's dental CAD/CAM market, valued at $0.11 billion in 2026, grows at 8.1% CAGR to 2031, emphasizing private practices amid NHS constraints. Adoption reaches 55-60%, driven by cosmetic demand and equity-backed chains standardizing digital workflows. Post-Brexit, the market adapts with MHRA regulations mirroring EU MDR for seamless imports.

Innovations focus on intraoral scanners and cloud-based software, enabling remote designs and reducing chair time by 30-50%. The UK excels in hybrid systems for multi-material use, like PEEK for temporaries, with 7.70% CAGR in equipment. Challenges include import costs, but growth in DSOs—15% of clinics—boosts scalability.

In international contexts, UK trends align with Los Angeles' private models, emphasizing patient-centric AI simulations. Aging demographics (20% over 65 by 2030) and cosmetic surges will propel market to higher shares.

Germany leads in scale and precision (7.64% CAGR to 2035), France in speed (9.9% CAGR), and the UK in agility (8.1% CAGR). Adoption: Germany 65%, France/UK 50-60%. Reimbursement is strongest in Germany/France, while UK relies on private funding.

Synergies emerge in cross-border R&D: Germany's engineering supports French AI, UK's chains adopt continental tech. Gaps include rural access in France/UK and regulatory hurdles post-Brexit.

Europe-wide trends include AI for predictive designs (20-30% error reduction) and 5-axis milling for undercuts. Germany pioneers zirconia multilayers, France wet milling for ceramics, UK intraoral scanners with AR previews. By 2026, hybrids process 10+ materials, enhancing versatility.

Challenges: High costs ($20k-80k/systems), training needs, and disparities in reimbursement. Future: AI/cloud integration, 3D printing growth, targeting 8-10% CAGR regionally.

Europe's dental CAD/CAM diversity—Germany's leadership, France's innovation, UK's efficiency—positions the region for sustained growth. As markets evolve, cross-national learnings will enhance global standards, benefiting areas like Los Angeles through tech exchanges.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

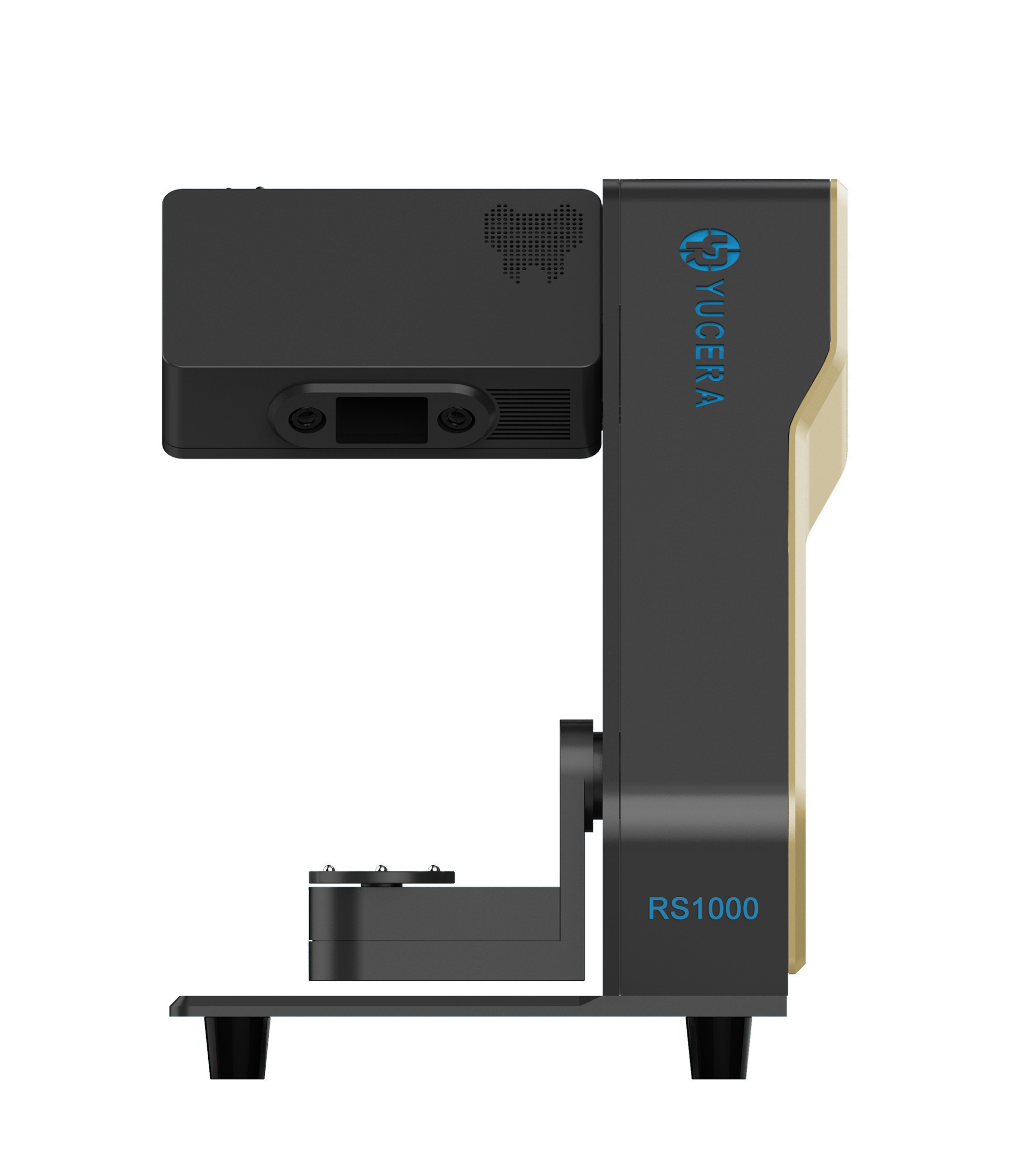

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

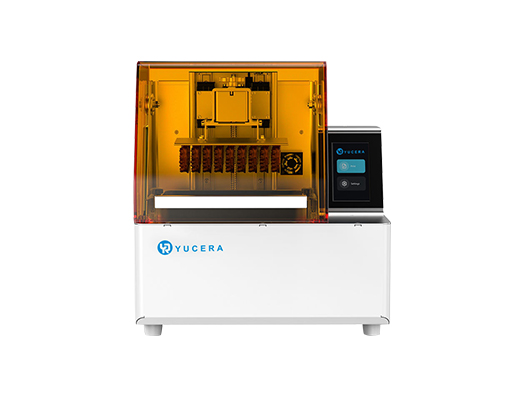

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more