What is a zirconia all-ceramic dental crown?

2024-09-19

2026-01-30

The dental industry in Eastern Europe is undergoing a digital transformation, with desktop scanners playing a crucial role in digitizing gypsum models and impressions for precise CAD/CAM workflows. These benchtop devices, essential for creating accurate 3D models of dental arches, dies, and articulators, support the production of crowns, bridges, and implants. In countries like Poland, Hungary, Romania, and the Czech Republic, the supply chain for these scanners faces unique challenges but also presents significant opportunities driven by market growth and dental tourism. As of 2026, the global dental CAD/CAM market stands at USD 3.1 billion, projected to reach USD 6.1 billion by 2034 at a CAGR of 8%, with Europe's segment growing at 9.0% through 2031. Eastern Europe's dental laboratories market, valued at USD 12.17 billion in 2025, is expected to expand to USD 18.35 billion by 2033 at a CAGR of 5.27%, fueled by increasing adoption of digital tools.

Desktop scanners enable labs to transition from traditional analog methods to digital precision, capturing data with accuracies of 8-12μm. However, the supply chain—encompassing raw materials, manufacturing, distribution, and integration—must navigate geopolitical, economic, and regulatory landscapes. This article examines these dynamics, drawing on recent data to highlight challenges and opportunities for Eastern European dental practices.

Desktop scanners utilize structured light or laser technology to digitize physical dental models, producing STL files for CAD software. In Eastern Europe, they bridge conventional impressions with digital fabrication, ideal for hybrid workflows where intraoral scanning isn't always feasible. The supply chain involves upstream suppliers of optical components and software, midstream manufacturers (often Asian or Western European), and downstream distributors serving local labs.

Key elements include zirconia blocks (priced at €16-20 each), software subscriptions, and maintenance parts. Eastern Europe's chain relies heavily on imports, with 4.5% inflation exacerbating costs. In Poland and Hungary, labs process 50-100 units monthly, integrating scanners into CAD/CAM systems that drive 40% of restorative procedures. Market dynamics show robust growth, but disruptions like those from recent global events highlight vulnerabilities.

Eastern Europe's desktop scanner supply chain grapples with several hurdles, amplified by the region's economic and regulatory environment.

These challenges could dampen innovation, reducing device availability by 20% if unaddressed, per industry surveys.

Despite challenges, Eastern Europe's desktop scanner supply chain offers promising avenues, leveraging market expansion and technological advancements.

These opportunities position Eastern Europe as a high-growth hub, with Budapest facilities reducing delays by 25% via UDI integration.

In Poland, Krakow labs leverage events like Krakdent for MDR workshops, achieving high compliance. Hungary focuses on tourism, with 30% of operations integrating cloud LIMS (€400-€900 annually) for UDI/PMS. Romania addresses 16.2% unmet needs through WET expansions, while the Czech Republic tackles rural gaps with technician training.

Strategies for success include:

Case studies show Krakow's 18% export rise and Bucharest's 15% cost cuts via exemptions.

By 2030, Eastern Europe's integration of AI and sustainable tech could accelerate growth, with 60% of labs adopting digital workflows. MDR simplifications in 2025, including WET expansions, will ease burdens, fostering innovation. As dental tourism surges, resilient supply chains will ensure competitive edges.

The desktop dental scanner supply chain in Eastern Europe balances significant challenges like regulatory costs and import dependencies with opportunities in tourism-driven growth and digital advancements. By embracing strategies for compliance and innovation, clinics in Poland, Hungary, Romania, and the Czech Republic can thrive, contributing to a robust regional market. This evolution not only enhances efficiency but also positions Eastern Europe as a key player in global digital dentistry.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

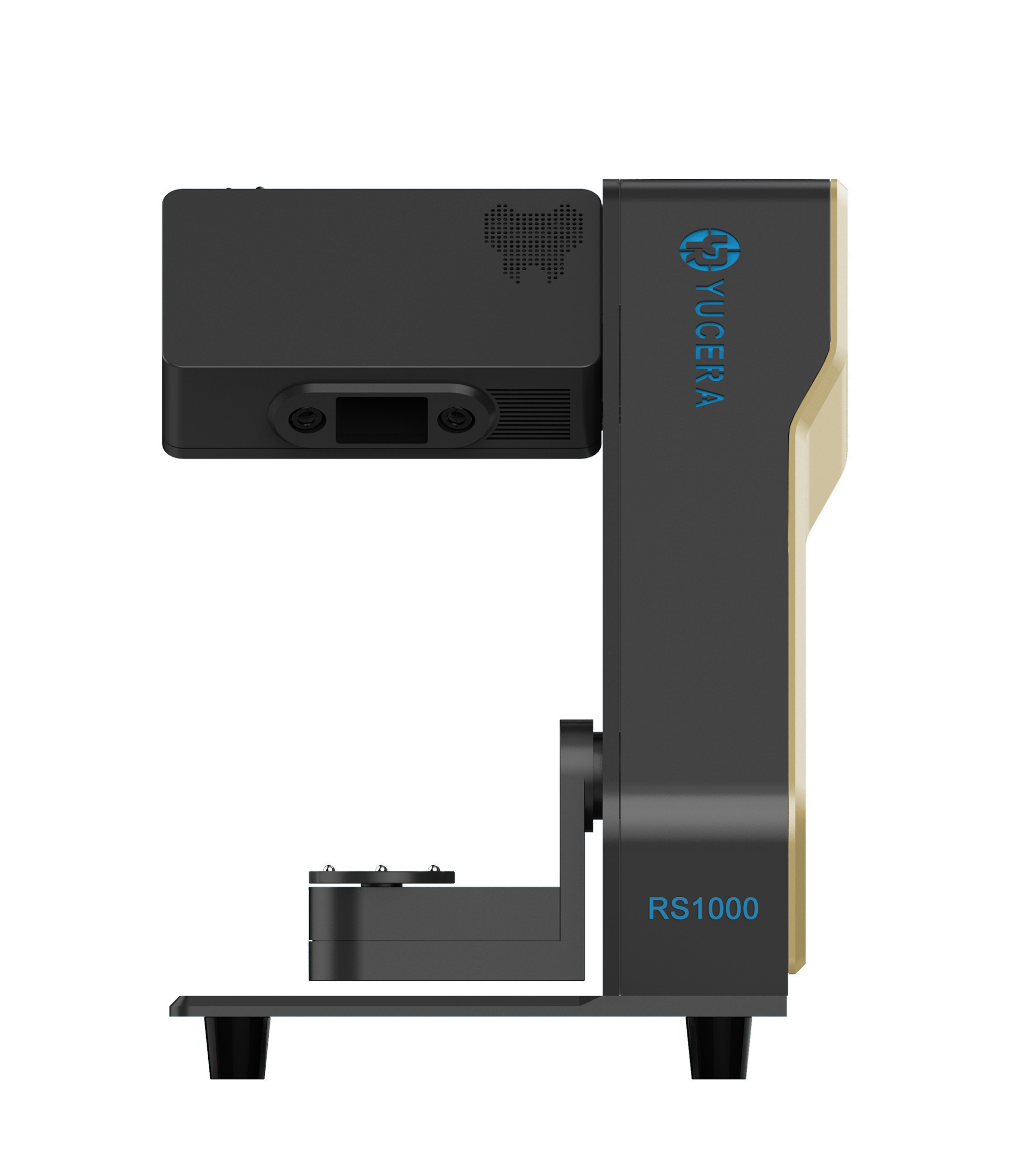

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

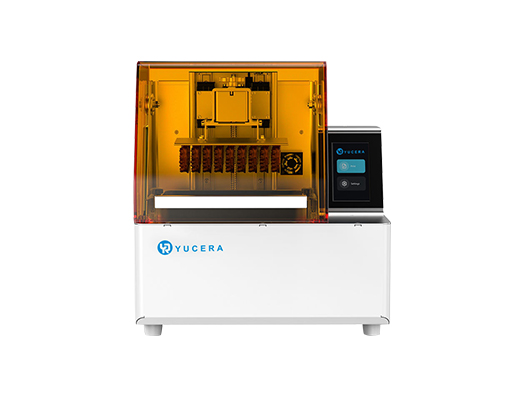

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more