Direct Dental Composite Veneers: Advantages and Disadvantages Compared to Other Materials

2025-04-14

2026-01-07

The dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) market in Latin America is experiencing robust growth, driven by increasing adoption of digital workflows, rising oral health awareness, and expanding access to advanced technologies. As of 2026, the broader Latin American dental devices market, which includes CAD/CAM systems, is valued at approximately USD 0.74 billion in 2025 and projected to reach USD 1.01 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.53%. Within this, the CAD/CAM segment—encompassing intraoral scanners, milling machines, 3D printers, and software—benefits from higher growth in digital diagnostics, estimated at a 5.23% CAGR through 2030.

Brazil emerges as the frontrunner in the region, commanding a significant market share and outpacing peers in adoption rates. This article delves into Brazil's ranking in Latin America's CAD/CAM market growth, comparing it with Mexico and Argentina based on available forecasts from 2023 to 2030. Data draws from industry analyses highlighting Brazil's leadership, with Mexico as a strong second and Argentina showing potential amid challenges.

Latin America's CAD/CAM market is part of the global digital dentistry surge, valued globally at around USD 3.1 billion in 2025 and expected to hit USD 6.1 billion by 2034 at an 8% CAGR. Regionally, growth is fueled by factors like dental tourism, government initiatives for digital health integration, and rising incidences of oral diseases such as caries and periodontal issues. The World Health Organization (WHO) reports that Brazil alone spent USD 3.713 billion on dental healthcare in 2019, underscoring the region's investment potential.

CAD/CAM technologies enable precise, efficient restorations like crowns and bridges, reducing chair time and material waste. In Latin America, the market for CAD/CAM milling machines was projected to grow at an 8.9% CAGR from 2019 to 2026, with continued momentum into the 2030s. Digital impressions in the region jumped 42% year-on-year to 85,000 in 2024, reflecting accelerated adoption of intraoral scanners and chairside systems.

Key drivers include:

Challenges include high equipment costs and uneven infrastructure, limiting penetration in rural areas. Nonetheless, the region's overall dental devices CAGR of 4.53% positions CAD/CAM as a high-growth subset, with digital segments outpacing the average.

Brazil holds the top spot in Latin America's CAD/CAM market, accounting for 35.65% of the regional dental devices share in 2024. As the largest economy and population center, Brazil's CAD/CAM sector benefits from a high burden of oral diseases—affecting millions, especially in low-income groups—and strong policy support. The National Oral Health Policy and Digital Health Strategy (2020-2028) promote CAD/CAM integration in public care, accelerating adoption.

Market forecasts indicate Brazil's dental devices segment, including CAD/CAM, will sustain growth above the regional average. While specific CAD/CAM CAGRs are embedded in broader trends, the country's digital diagnostic equipment is poised for mid-single-digit expansion, aligning with the regional 5.23% for similar categories. Brazil's leadership is evident in domestic manufacturing and regulatory reforms, such as ANVISA's Law 14.874/24, which cuts approval times for CAD/CAM devices to 60 days.

In 2026, Brazil's CAD/CAM adoption is driven by urban clinics in São Paulo and Rio de Janeiro, where chairside milling and intraoral scanners are standard for aesthetic restorations. Dental tourism further amplifies demand for premium CAD/CAM solutions, positioning Brazil as the growth engine for Latin America.

Mexico ranks second in Latin America's CAD/CAM landscape, benefiting from proximity to North American markets and a thriving dental tourism industry. The country's dental devices market emphasizes hybrid care models with cloud-enabled CAD/CAM software, supporting teledentistry rollouts since 2022.

While no isolated CAD/CAM CAGR is available, Mexico's overall dental sector aligns with the regional 4.53% growth, with digital segments like intraoral scanners and 3D printers showing faster uptake due to portable diagnostics. Dental tourism in cities like Tijuana and Cancun drives demand for efficient CAD/CAM workflows, contributing a 1.20% CAGR uplift regionally.

Compared to Brazil, Mexico's market is smaller but competitive, with strengths in cost-effective imports and integration with U.S. supply chains. Forecasts to 2030 suggest steady expansion, though slightly below Brazil's pace due to economic variability. Mexico's focus on teledentistry (0.70% impact) enhances CAD/CAM accessibility in remote areas, narrowing the gap with Brazil.

Argentina occupies a lower ranking in Latin America's CAD/CAM market, influenced by economic instability and patchy reimbursement systems. However, it benefits from Mercosur tariff reductions on digital radiology and CAD/CAM equipment (0.50% impact), facilitating imports.

The country's dental devices growth tracks the regional 4.53% CAGR, with digital segments like teledentistry providing short-term boosts. Argentina's CAD/CAM adoption is concentrated in urban centers like Buenos Aires, where 3D printing and milling machines support restorative procedures. Forecasts indicate moderate growth to 2030, potentially lagging Brazil and Mexico due to slower infrastructure development.

Despite challenges, Argentina shows promise in collaborative regional initiatives, such as Mercosur-driven tech sharing, which could elevate its ranking if economic conditions improve.

In 2026, Brazil ranks first in Latin America's CAD/CAM market growth and share, followed by Mexico in second and Argentina in a distant third among major players. While Colombia is projected to achieve the highest CAGR at 7.21% through 2030—outpacing the regional average due to rapid digital upgrades—Brazil's sheer scale (35.65% share) solidifies its leadership.

Overall, Latin America's CAD/CAM growth lags global averages (8-10%) but shows acceleration in digital adoption, with Brazil driving 35-40% of regional momentum.

Brazil's CAD/CAM dental market firmly ranks first in Latin America in 2026, outstripping Mexico and Argentina in growth rate, share, and adoption. With forecasts pointing to sustained expansion through 2030, driven by digital health strategies and tourism, the region offers opportunities for further integration. As CAD/CAM evolves, Brazil's leadership will likely persist, while Mexico and Argentina contribute to a more balanced ecosystem. Stakeholders should focus on affordability and training to unlock full potential across Latin America.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

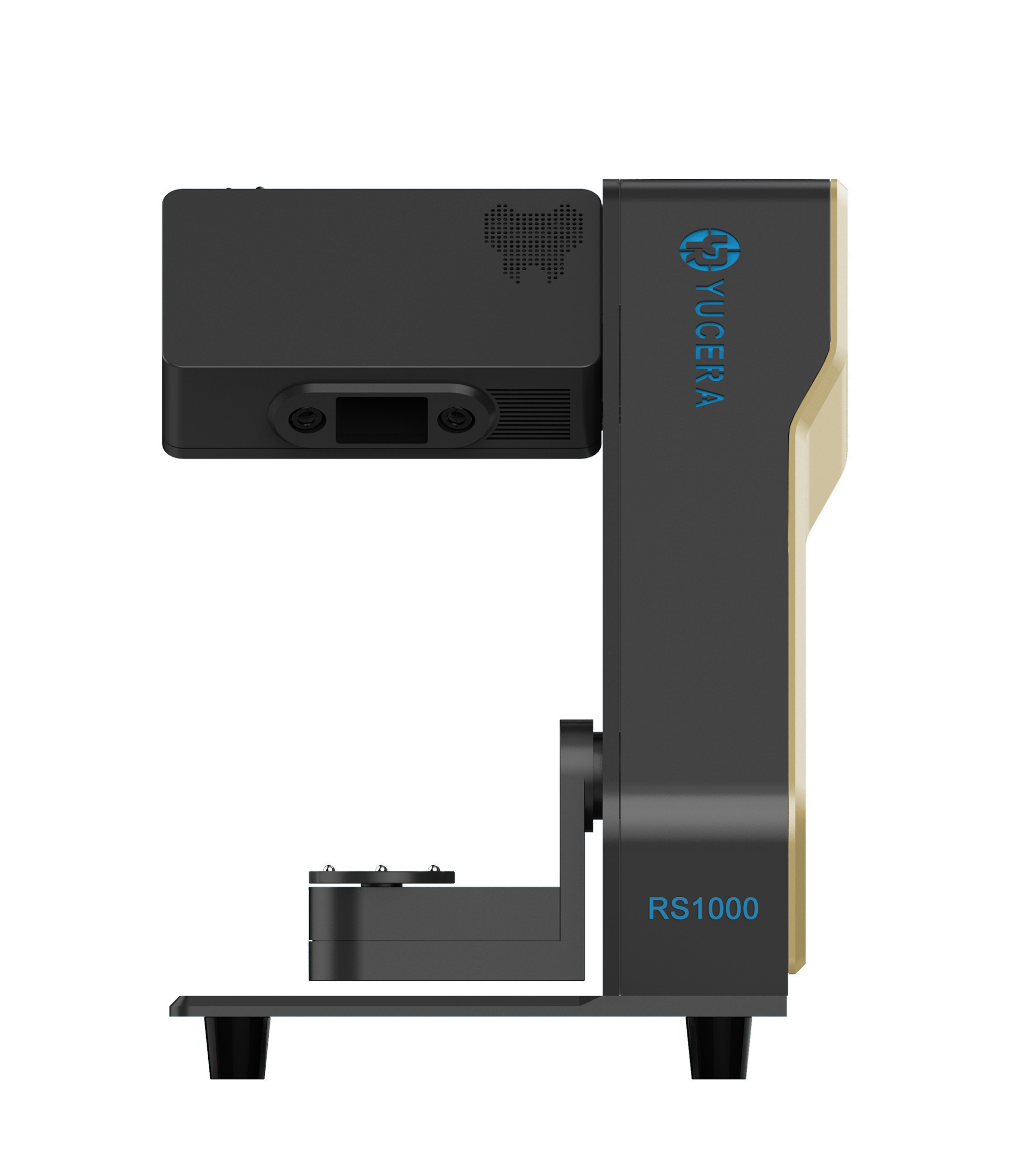

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

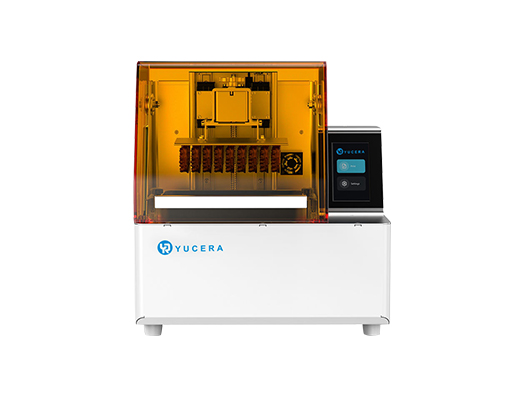

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more