Comprehensive Guide to Zirconia Veneers

2024-08-10

2026-01-18

The Asia-Pacific (APAC) region is witnessing an explosive growth in dental CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology, transforming restorative dentistry with precise, efficient fabrication of crowns, bridges, veneers, inlays, onlays, abutments, and frameworks. Driven by rapid urbanization, rising disposable incomes, an aging population, and increasing awareness of oral health, the APAC dental CAD/CAM market is poised for remarkable expansion. Globally, the dental CAD/CAM market was valued at $2.5 billion in 2022, projected to reach $5.5 billion by 2030 at a CAGR of 10.8%. In APAC, the CAD/CAM dental devices market stood at $1.10 billion in 2023, expected to grow to $2.09 billion by 2031 at a CAGR of 8.3%.

China and India, as emerging powerhouses, are at the forefront, contributing significantly to this boom through dental tourism, technological adoption, and government initiatives. However, challenges like infrastructure limitations and high costs persist. This article explores the opportunities and hurdles in these markets, drawing parallels for global collaborations, such as with advanced clinics in Los Angeles where similar digital workflows enhance cross-regional efficiency. With APAC's dental market projected to expand from $9.04 billion in 2025 to $22.09 billion by 2032 at a CAGR of 13.6%, the region's CAD/CAM segment is a key driver.

APAC's dental CAD/CAM sector is the fastest-growing regionally, fueled by a large population base (over 4.5 billion), rising edentulism, and demand for aesthetic restorations. The global dental CAD/CAM market is set to reach $6.22 billion by 2033 at a CAGR of 9.1%, with APAC leading due to economic development in China and India. Key subsegments, like milling machines, are valued at $1.68 billion in 2019, projected to $3.01 billion by 2026 at a CAGR of 9.24%, with APAC—especially India, China, South Korea, and Singapore—recording maximum growth.

Drivers include:

The digital dental diagnosis and treatment service market, intertwined with CAD/CAM, is expected to grow from $1.57 billion in 2026 to $4.56 billion by 2035, with APAC at the fastest CAGR. In APAC, the broader dental market's 13.6% CAGR underscores CAD/CAM's role in modernizing clinics and labs.

China leads APAC's dental CAD/CAM growth, dominating the regional market in 2024 with strong government backing for healthcare digitalization. The country's dental market contributes significantly to APAC's $9.04 billion projection for 2025, driven by a population of 1.4 billion and rising middle-class demand for aesthetics. Domestic manufacturers invest in 3D imaging, CAD/CAM, and cloud systems, enhancing accessibility and precision.

Opportunities:

Challenges:

China's trajectory positions it as a global exporter, with CAD/CAM aiding in reducing treatment times by 30-50%.

India's dental CAD/CAM market is accelerating, benefiting from a young population (1.4 billion) and booming dental tourism in cities like Mumbai and Delhi. As part of APAC's fastest-growing segment, India's market aligns with the region's 8.0% CAGR for CAD/CAM, driven by modernization and cost-effective solutions.

Opportunities:

Challenges:

India's market could triple by 2030, leveraging tech for preventive care.

China's scale (dense urban infrastructure, government-driven) outpaces India's (tourism-focused, emerging), with China dominating APAC in 2024. Both benefit from population-driven demand, but China's 15%+ implant growth contrasts India's tourism edge. Opportunities converge on digitalization, while challenges like rural gaps are shared, though India's affordability aids faster catch-up.

By 2033, APAC's CAD/CAM influence will grow, with China and India driving 8-13% CAGRs through AI, 3D printing, and expanded access. Collaborations with global hubs like Los Angeles could accelerate innovations, addressing challenges for inclusive growth.

APAC's dental CAD/CAM explosion, led by China and India's opportunities in tourism and digitalization, promises transformative impacts despite infrastructure challenges. As markets mature, strategic investments will unlock full potential, benefiting global dentistry.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

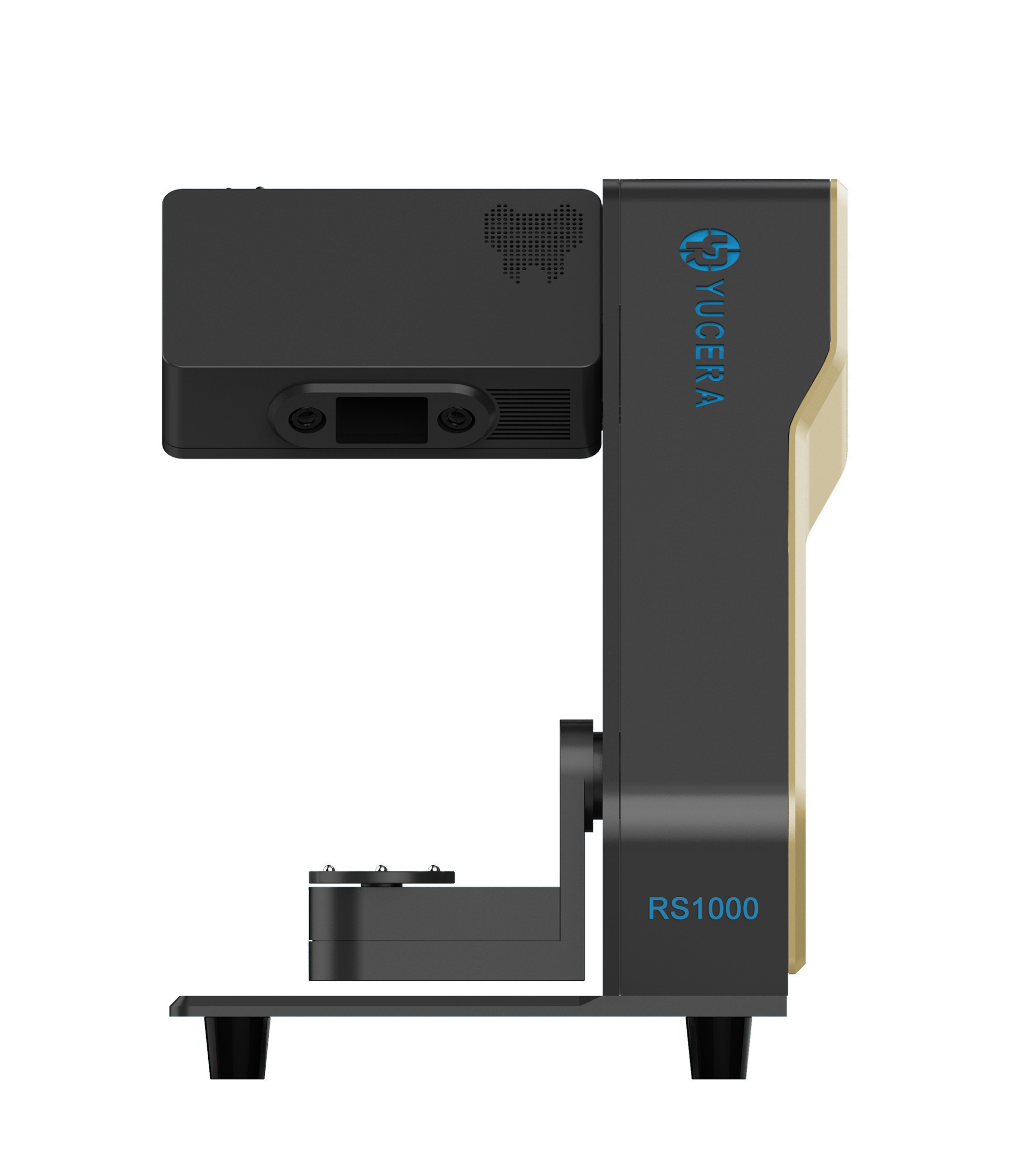

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

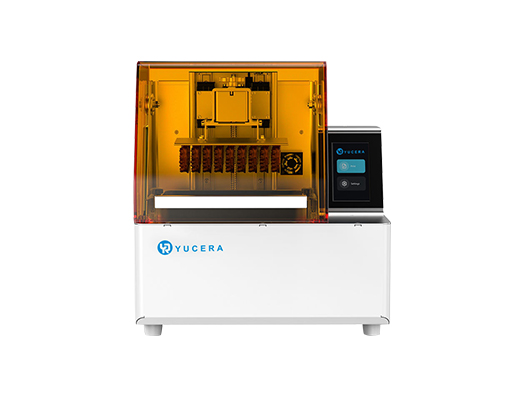

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more