4-Axis vs 5-Axis Dental Milling Machines: Which Is Worth Investing In 2026?

2026-01-13

2026-01-09

In Brazil's thriving cosmetic dentistry sector, all-ceramic metal-free restorations, particularly full zirconia (all-zirconia) options, have established a commanding presence. Driven by patient demands for natural aesthetics, biocompatibility, and durability, these materials dominate fixed prosthetics like crowns, bridges, and veneers. As of 2026, Brazil's cosmetic dentistry market is projected to reach approximately USD 1.2 billion, growing at a CAGR of 10.5% toward USD 1.59 billion by 2030. Within this, all-ceramic restorations, especially zirconia-based, hold a significant share, reflecting the country's emphasis on smile makeovers in urban centers like São Paulo and Rio de Janeiro.

This article explores the current dominance of full zirconia in Brazil's cosmetic dentistry, the factors sustaining it, emerging challenges, and projections on its longevity amid evolving materials and technologies.

All-ceramic metal-free restorations have revolutionized cosmetic dentistry by eliminating metal substructures, which can cause graying at the gumline and allergic reactions. Full zirconia, composed primarily of zirconium dioxide, stands out for its high strength (900–1200 MPa flexural strength), fracture resistance, and aesthetic versatility. In Brazil, where aesthetic procedures like whitening and smile redesigns are popular, zirconia accounts for over 75% of the dental crowns and bridges market share as of 2024, surpassing metal-ceramics and other composites.

The Brazilian restorative and endodontic dentistry market, valued at USD 763 million in 2023, is expected to reach USD 1.49 billion by 2032 at a CAGR of 7.7%. Within this, all-ceramic options lead due to their metal-free appeal, with zirconia dominating in high-load and aesthetic zones. In cosmetic applications, full zirconia restorations are favored for their monolithic construction, which reduces chipping risks compared to layered ceramics. Market data shows ceramics hold the largest segment in orthodontic bridges and crowns globally, with superior aesthetics and patient preference for metal-free solutions driving adoption in Brazil.

In São Paulo and Rio de Janeiro—hubs for dental tourism and private clinics—zirconia restorations are standard for anterior crowns and veneers. The rise of digital dentistry, including CAD/CAM systems, has amplified zirconia's use, enabling precise milling from blocks or discs. Brazil's digital dentistry market, growing at around 3% CAGR, supports this by facilitating chairside and lab-based production of zirconia prosthetics.

Composite resins, while dominant in direct restorations (leading the restorative materials segment), lag in indirect cosmetic applications where durability is key. All-zirconia restorations offer longevity (10–15 years survival rates in clinical studies), making them ideal for Brazil's high caries prevalence and aesthetic-focused patient base.

Several drivers underpin the ongoing supremacy of full zirconia in Brazil's cosmetic dentistry:

Global trends mirror this: the zirconia-based dental ceramics market is set to grow from USD 329 million in 2025 to USD 771 million by 2035 at a CAGR of 8.9%. In Brazil, this translates to continued dominance in aesthetic restorations.

Despite its stronghold, full zirconia faces hurdles that could erode its position in Brazil's cosmetic dentistry market:

These challenges are amplified in Brazil's mixed economy, where public health systems prioritize cost-effective options over premium aesthetics.

In 2026, full zirconia's dominance in Brazil's cosmetic dentistry appears secure, with projections indicating sustained leadership through 2030. The market's CAGR of 10.5% for cosmetic dentistry supports this, as zirconia aligns with trends toward metal-free, digitally fabricated restorations. Innovations like high-speed sintering and additive manufacturing will enhance zirconia's versatility, potentially extending its reign.

However, dominance may wane by 2032–2035 if alternatives gain ground. Composite resins and hybrid materials could capture more share in minimally invasive cosmetics, especially with AI-driven designs reducing costs. If economic pressures intensify, affordable options might prevail over zirconia's premium positioning.

Optimistically, zirconia's evolution—such as composition-gradient materials combining strength and translucency—could maintain its edge. Brazil's leadership in Latin American zirconia growth (8–10% CAGR) suggests dominance for at least another 5–7 years, barring major disruptions.

In São Paulo and Rio, where aesthetic demands are highest, zirconia will likely remain king. Nationwide, expanded training and policy support could prolong its status, but diversification toward sustainable, cost-effective materials looms.

Full zirconia and all-ceramic metal-free restorations currently rule Brazil's cosmetic dentistry market, bolstered by unmatched durability, aesthetics, and biocompatibility. With the sector poised for double-digit growth, dominance seems assured through 2026 and into the early 2030s. Yet, challenges like costs, competition, and skill gaps could shorten this timeline if unaddressed.

As Brazil advances in digital dentistry, zirconia's future hinges on innovation and accessibility. For practitioners in São Paulo, Rio de Janeiro, and emerging markets, balancing zirconia's strengths with evolving alternatives will define the next era of cosmetic restorations.

Dry & wet milling for zirconia, PMMA, wax with auto tool changer.

learn more

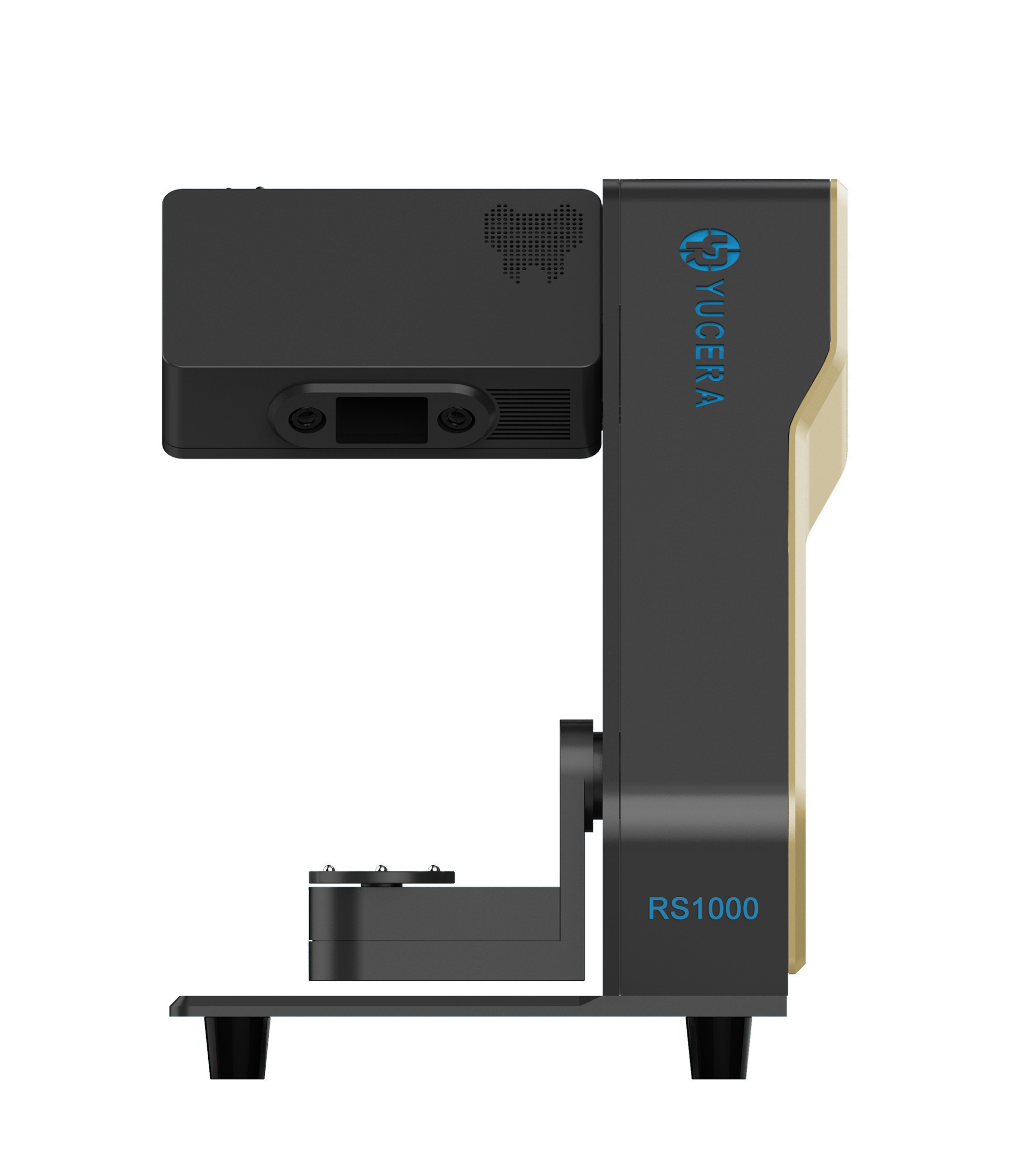

High-precision 3D scanning, AI calibration, full-arch accuracy.

learn more

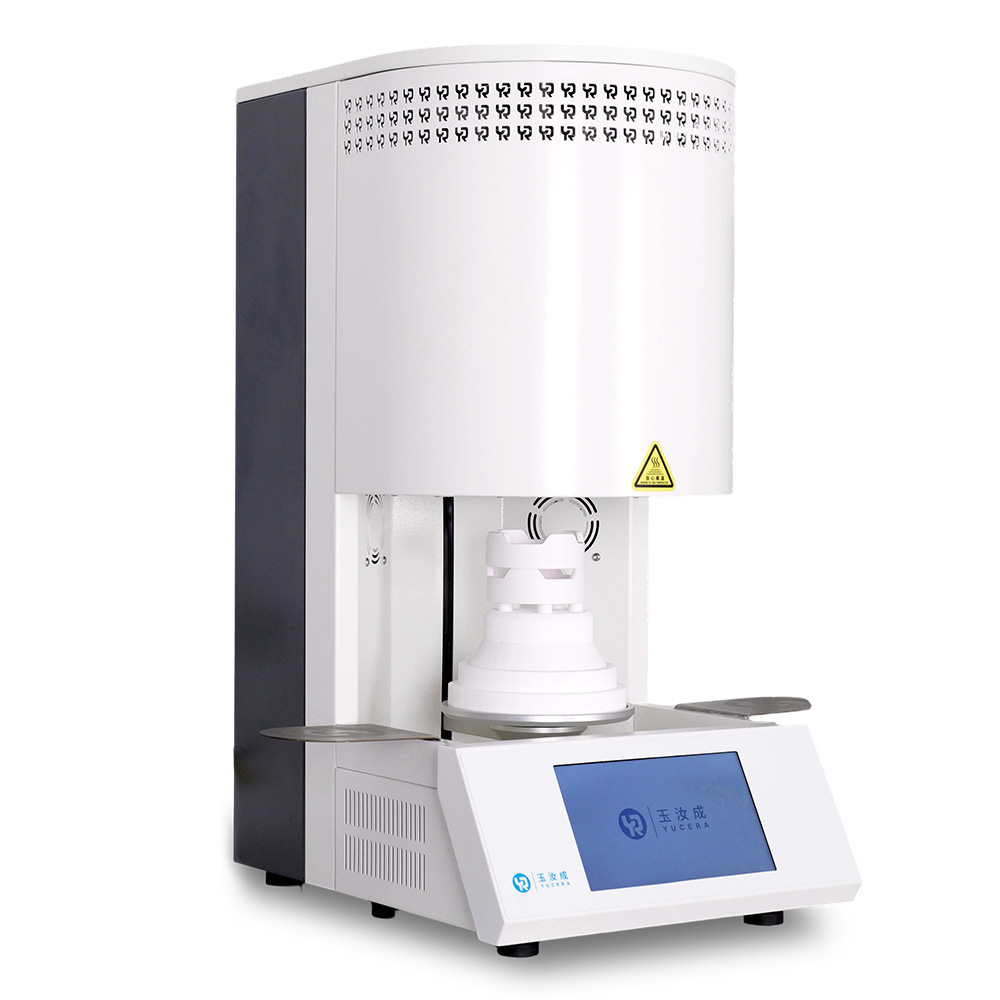

40-min full sintering with 57% incisal translucency and 1050 MPa strength.

learn more

40-min cycle for 60 crowns, dual-layer crucible and 200°C/min heating.

learn more

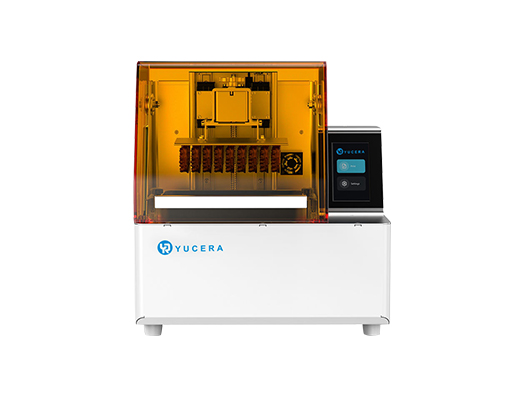

High-speed LCD printer for guides, temporaries, models with 8K resolution.

learn more